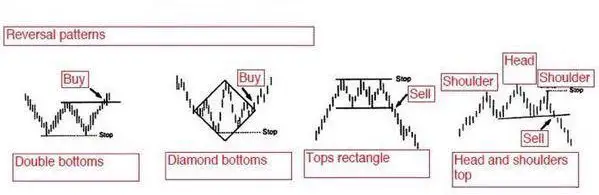

Reversal patterns happen when a chart has a strong break from its current trend and its momentum reverses course. This can happen on a trend line break of resistance or support out of a price range, a gap in price, or a long wick candlestick that changes direction and reverses off of highs in an uptrend or lows in a downtrend. A reversal shows that buyers have lost control of an uptrend or sellers have lost control of a downtrend and price is no longer moving in the previous trend. This is a change in the path of least resistance.

Reversal patterns happen when a chart has a strong break from its current trend and its momentum reverses course. This can happen on a trend line break of resistance or support out of a price range, a gap in price, or a long wick candlestick that changes direction and reverses off of highs in an uptrend or lows in a downtrend. A reversal shows that buyers have lost control of an uptrend or sellers have lost control of a downtrend and price is no longer moving in the previous trend. This is a change in the path of least resistance.

Here are four of the most common chart patterns that show a reversal pattern on a chart:

Here is a list of the seven most popular reversal candlestick patterns used in technical analysis to find a high probability price level on a chart for a reversal of a trend. These candlesticks can create good risk/reward ratios by setting stop losses at the candle extremes at the highs for reversals in uptrends and the lows for reversals in downtrends. These patterns show a shifting in buying power or selling power through the price action of the candle being unable to make higher highs in an uptrend or lower lows in a downtrend.

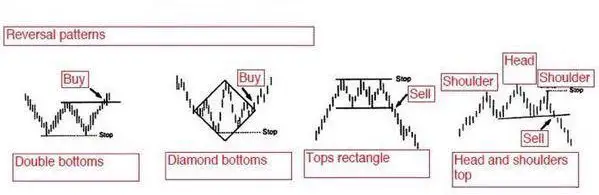

Doji reversal candles:

Doji candlestick patterns are commonly formed when a trading range in a period has both the open and closing price at near the same price level. A doji candlestick usually signals indecision for the future direction in a chart. A doji candle can signal either a pause in the current trend and also high probability that the trend is about to end or at least go sideways. A dragonfly doji can signal the end of a downtrend and a gravestone doji can signal the end of an uptrend.

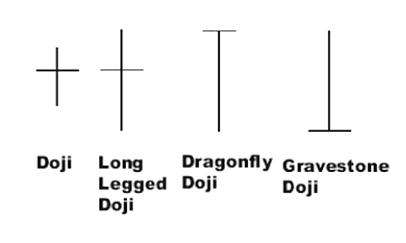

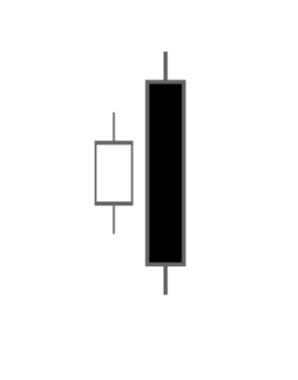

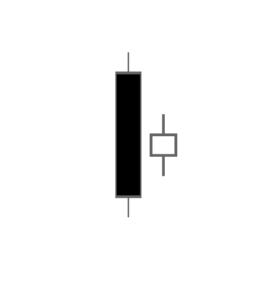

Abandoned baby candlestick pattern:

Vistula / CC0

The abandoned baby is a three-candle reversal pattern in an uptrend or downtrend. In an uptrend it can help define a price action top and in a downtrend can help define a bottom in price. The first candle moves strongly in the direction of the current trend, the middle candle is smaller and gaps away from the first candle usually forming a doji star, and the final third candle is a gap down in price reversal candle back inside the range of the first bullish candle.

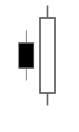

Engulfing candlestick patterns:

Wikipedia

Engulfing candlestick patterns are two-candles in a row that can signal a reversal of the current trend on a chart. The second candle range completely engulfs the trading range of the previous smaller candle showing a failure to go higher in an uptrend or lower in a downtrend and also breaking out above a previous bearish candle or breaking below a previous bullish candle.

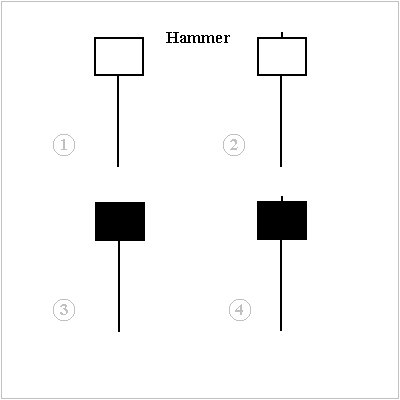

Hammer candles:

Altafqadir at English Wikipedia / CC BY (https://creativecommons.org/licenses/by/3.0)

The signal hammer candle can signal a bottoming pattern during a downtrend as new lows are rejected and price closes higher than the intra-day lows. A hammer candle has a small body, little or no upper wick, and a long lower wick that makes a new price low but then reverses strongly. The hammer shows the failure of bears to hold prices lower.

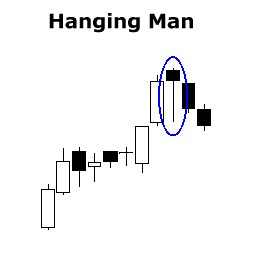

A hanging man candle pattern is a bearish reversal signal on a chart. When a hanging man candle happens inside an uptrend of higher highs and higher lows it can signal the high probability of a reversal or at least sideways action following it. Some people use the hanging man as a signal in itself but the probabilities of success are better if it happens at the same time as other technical indicators like previous price resistance or a technical overbought reading on the chart. The hanging man shows the first sign of weakness in an uptrend as prices drop lower and close lower than the close. This is usually an early sign of distribution inside an uptrend.

Harami candle:

Wikipedia

A harami two-candle pattern shows prices could begin to stop trending in the previous chart direction, which could lead to a trading range first before a big reversal in the opposite direction. A harami is a candle that forms inside the previous candle showing a loss of momentum for a trend. A harami pattern has a higher probability of success if a chart is also overbought or oversold when the pattern occurs. They can occur in either uptrends or downtrends.

Chart Courtesy of StockCharts.com

A shooting star candle usually happens during a strong uptrend when a market opens and then goes higher but reverses and closes lower than the highs near the opening price or below. The larger the upper wick is relation to the candle body the more bearish it is as it has created new overhead resistance and shows a rejection of buyers at higher prices. A shooting star is a one of the most bearish candlestick patterns and can signal the end of an uptrend and a high probability of a downtrend reversal beginning.

These are the key chart patterns and candlestick patterns to keep in mind when looking to identify when a trend is bending and could be about to end on a chart you are following.