Don’t be a Cheapskate Trader: Pay for Quality

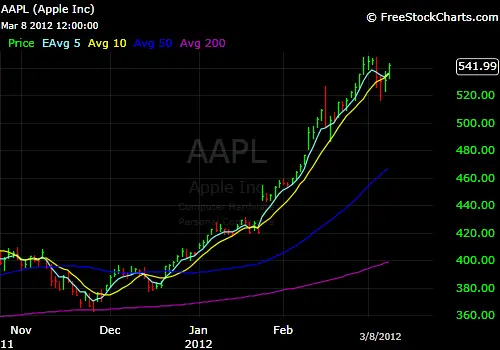

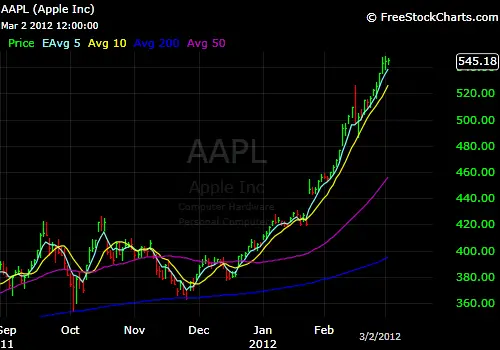

Many new traders and new investors make the mistake of looking for and buying cheap stocks. Do not fall into the cheapskate trader trap, instead just pay for quality. Cheap stocks are cheap for a reason, they are junk. Quality stocks rarely if ever trade for under $15 and the […]

Don’t be a Cheapskate Trader: Pay for Quality Read More »