How To Use Moving Averages – Moving Average Trading 101

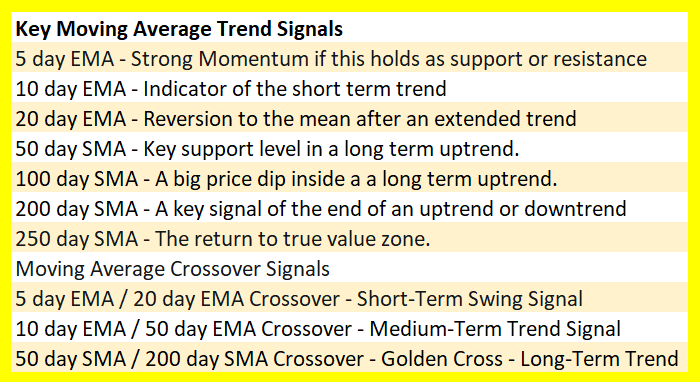

A simple moving average is a technical indicator that you can use to quantify price trends and trading signals. Moving averages can be used for the following: Entry signal Exit signal Trailing stop Stop loss Profit target To scale into a position Trend indicator Risk management Quantify position sizing To measure volatility To manage volatility […]

How To Use Moving Averages – Moving Average Trading 101 Read More »