Sizzle Index

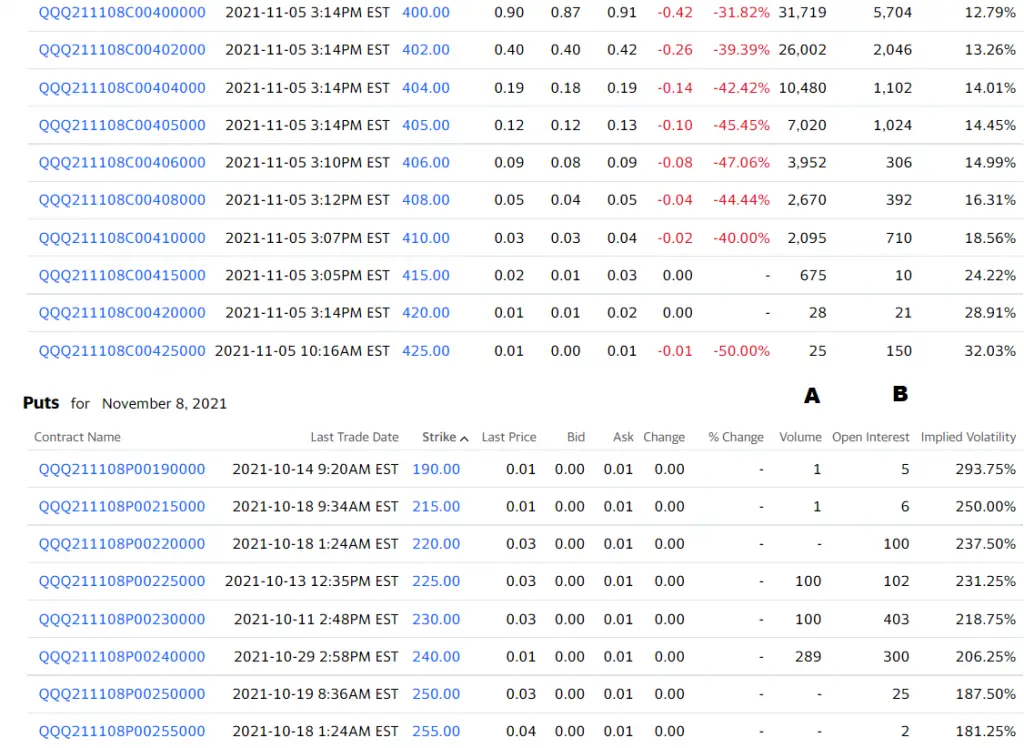

The Sizzle Index is a feature on the thinkorswim platform that filters to find stocks that currently have an increase in the number of option contracts traded in relation to the last 5 days’ average of activity. The Sizzle Index is calculated as the ratio of the current total volume of put and call options […]