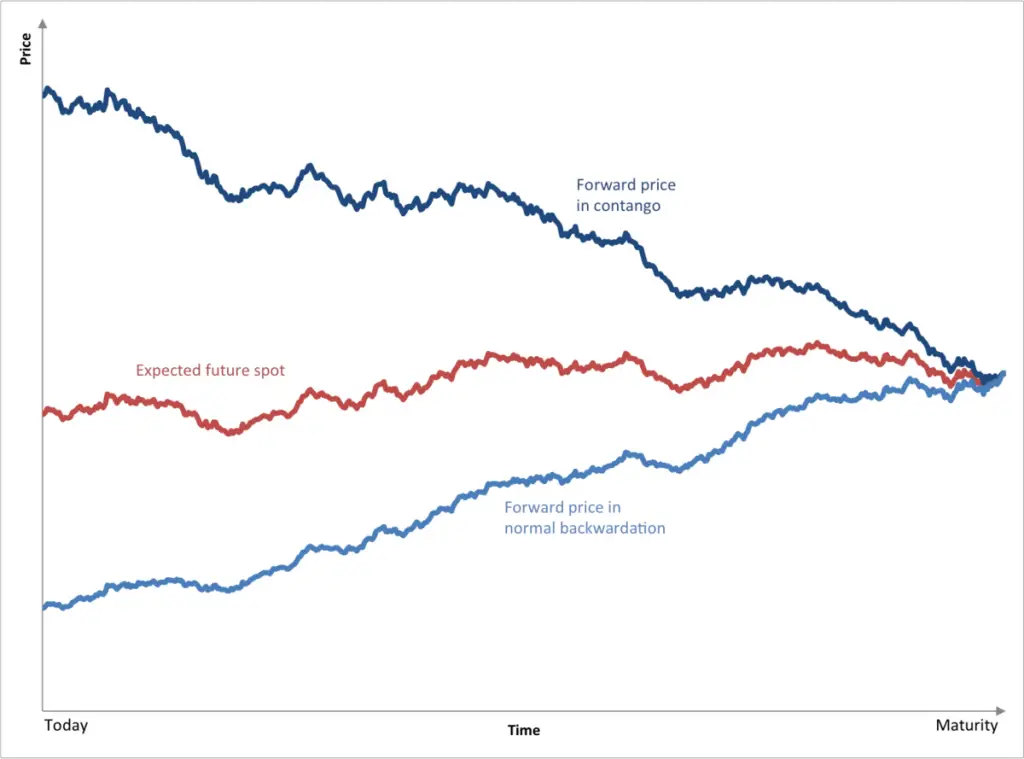

Contango is a situation in the price action of the commodities market where the futures forward price of a commodity is more than the spot price expected of the futures contract at its maturity and delivery date. The opposite condition in the futures market to contango is called backwardation. The commodity market is in backwardation whenever the futures contract current market price is lower than the spot price expected for a specific commodity. Backwardation is favorable for holders of a commodity who have long positions since they want the futures price to rise to the level of the current spot price.

During a situation of contango, speculators and arbitrageurs will pay a current higher price for a commodity contract for delivery at a point in the future than the expected price of the commodity in the future. It can be caused by traders wanting to pay a higher price to have the commodity at a later date instead of paying the expenses of the storage and costs to carry of purchasing the commodity now. The other side of the trade are the people and companies producing or holding the commodities that need to hedge to remove the uncertainty of future prices. The hedgers are happy to sell the futures contracts now at a higher price and receive the better returns as they are already carrying the commodity and can deliver sooner.

A contango market in futures is a normal market environment due to the cost to carry physical commodities.