People Who Build Wealth Understand the Exponential Function in Math

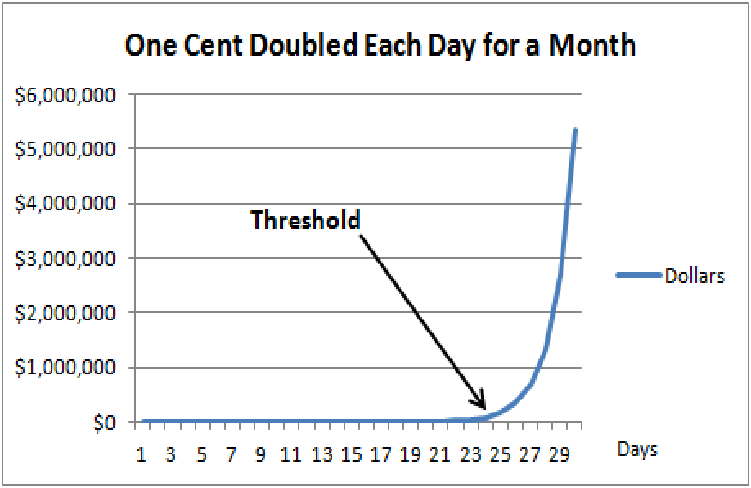

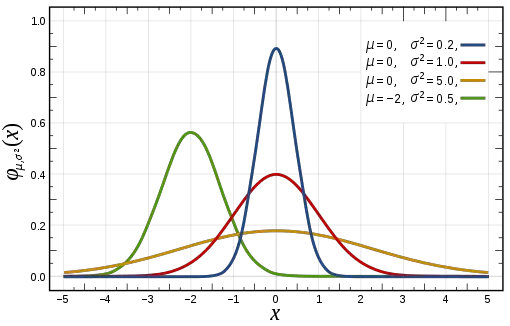

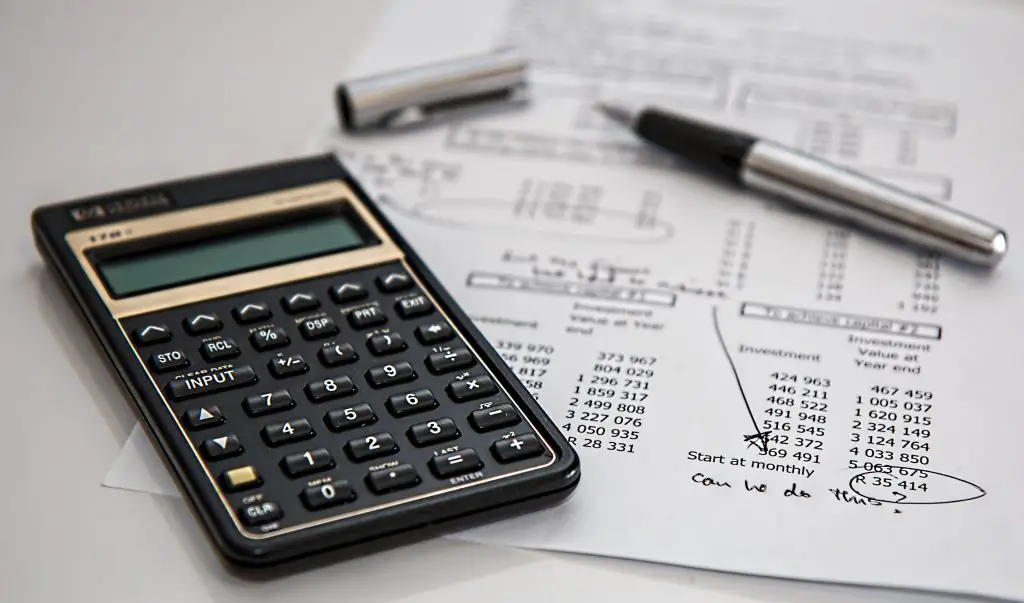

The difference between those who build lasting wealth and those who struggle financially often comes down to a single mathematical concept: the exponential function. While most people understand basic arithmetic, wealthy individuals grasp something far more powerful. They know that money doesn’t just accumulate over time; it multiplies. This fundamental insight transforms how they think […]

People Who Build Wealth Understand the Exponential Function in Math Read More »