5 Price Action Rules EVERY Trader NEEDS To Know

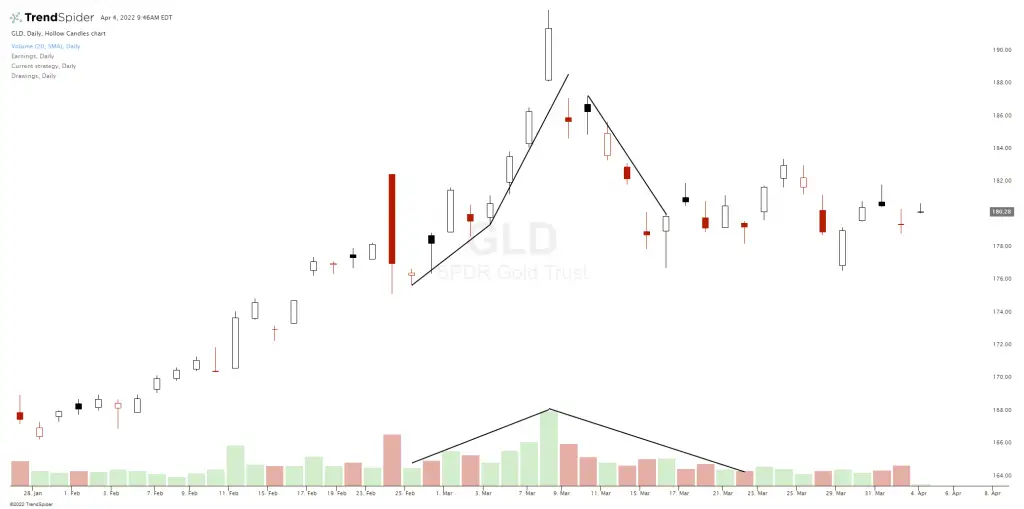

For price action traders, the movement of price itself is their primary signal for taking entries and exits. They let momentum, the trend, and movement filter their trading decisions. A price action trading strategy is a process for using new incoming and evolving price action data to make buy and sell decisions on a watch list […]

5 Price Action Rules EVERY Trader NEEDS To Know Read More »