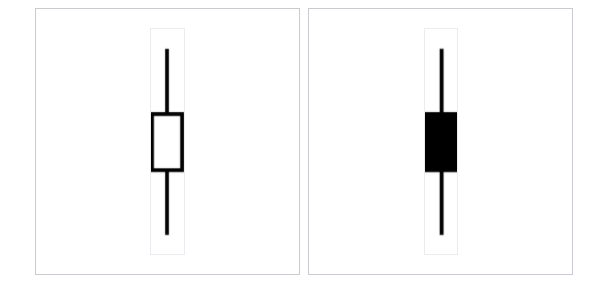

Long Legged Doji Candlestick Patterns Explained

What is a long-legged doji candlestick pattern? The long-legged doji candlestick pattern has both long upper and lower shadows (wicks) and generally has a closing price near where it opened in the time frame of the candle. The long-legged doji candlestick can signal extreme indecision in the current market with a large trading range but […]

Long Legged Doji Candlestick Patterns Explained Read More »