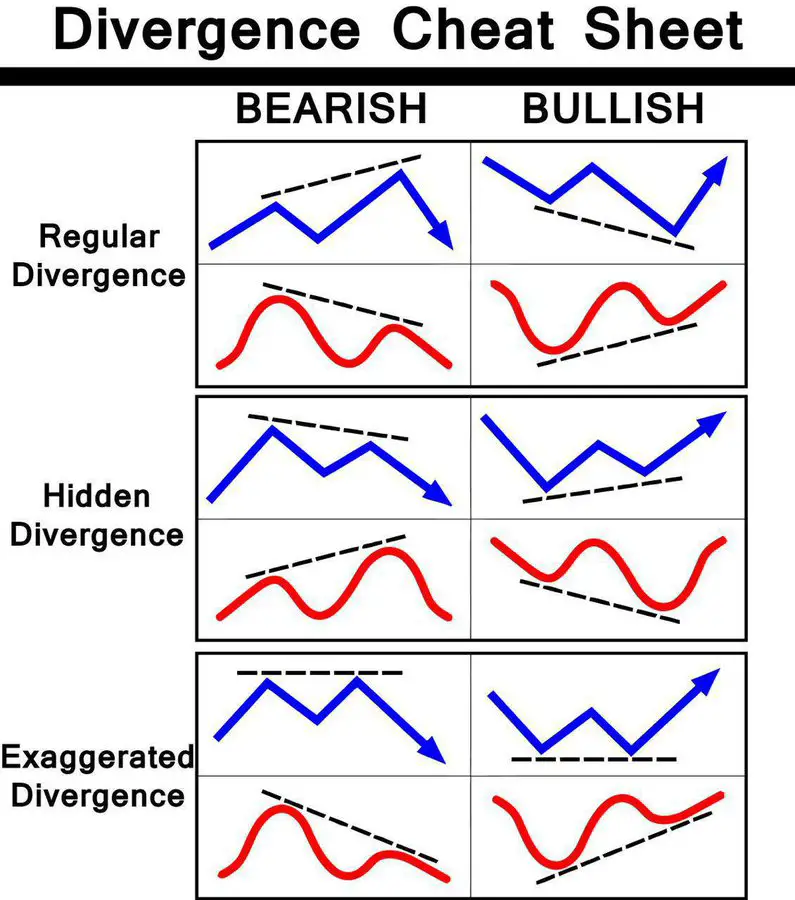

What is A Bearish Divergence?

A bearish divergence is defined on a chart when prices make new higher highs but a technical indicator that is an oscillator doesn’t make a new high at the same time. This is a signal that bullish sentiment is losing momentum with the high probability that sellers are stepping in and the market may be […]

What is A Bearish Divergence? Read More »