Joel Greenblatt Magic Formula Investing

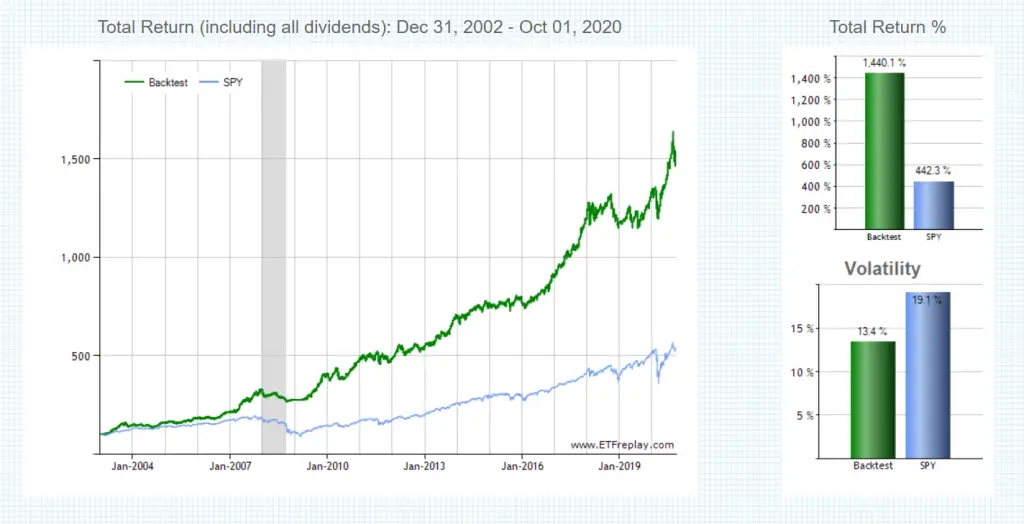

The “magic formula investing” system parameters and principles are used by Joel Greenblatt in his approach to value investing to outperform the market. In his book ‘The Little Book that Beats the Market’, Greenblatt writes that this system buys cheap stocks of 30 companies that have high earnings yield and also a high return on […]

Joel Greenblatt Magic Formula Investing Read More »