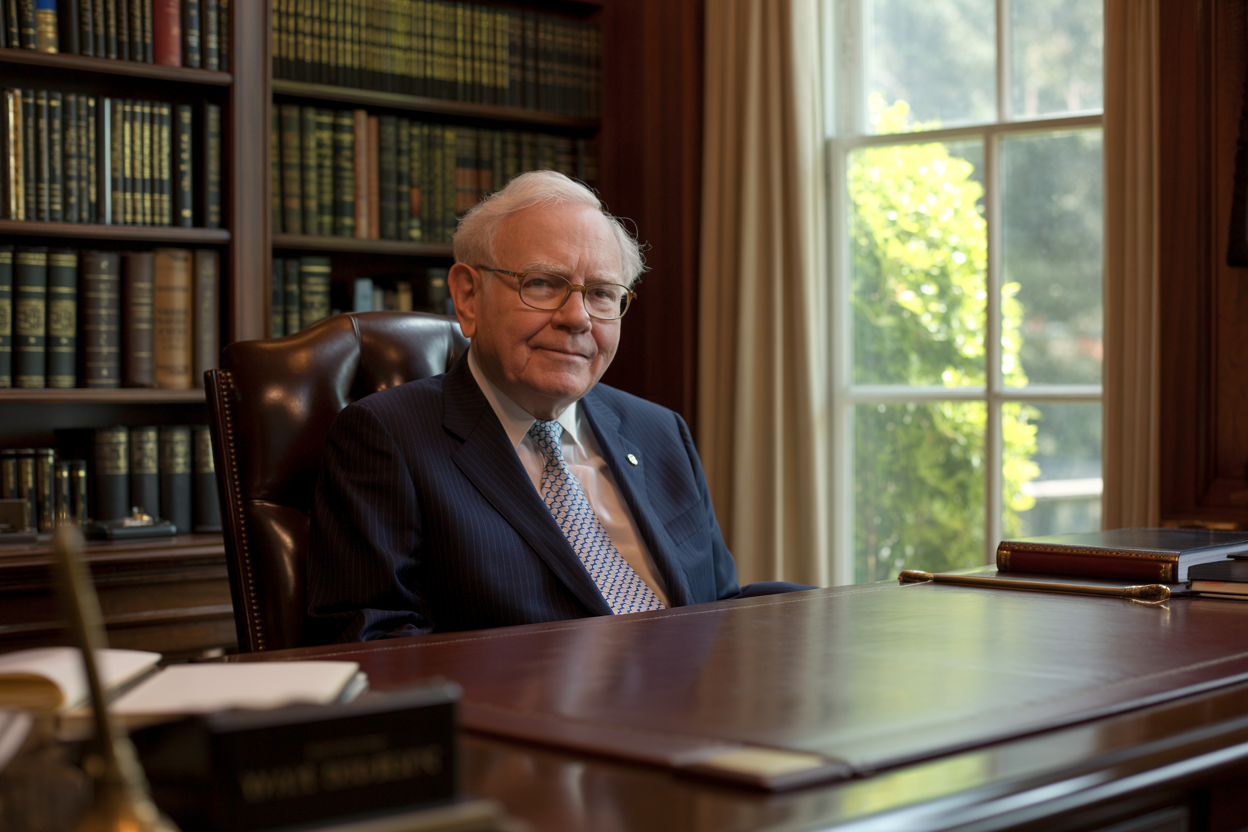

The 5 Formulas for Successful Investing According to Warren Buffett

Warren Buffett’s investment philosophy has created extraordinary wealth over six decades, transforming Berkshire Hathaway from a struggling textile company into one of the world’s most valuable corporations. His approach isn’t based on complex algorithms or market timing, but rather on fundamental principles that any investor can understand and apply. These five essential formulas form the […]

The 5 Formulas for Successful Investing According to Warren Buffett Read More »