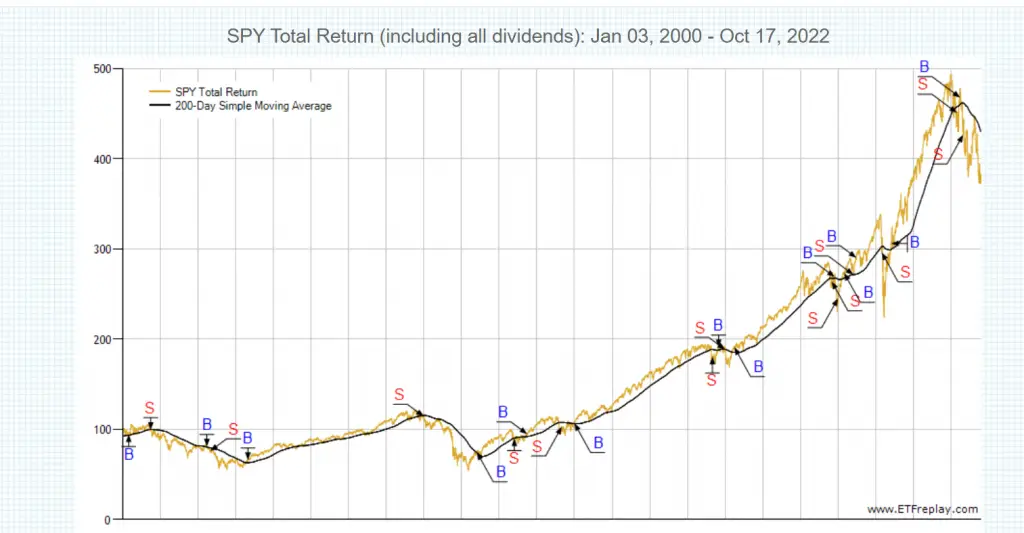

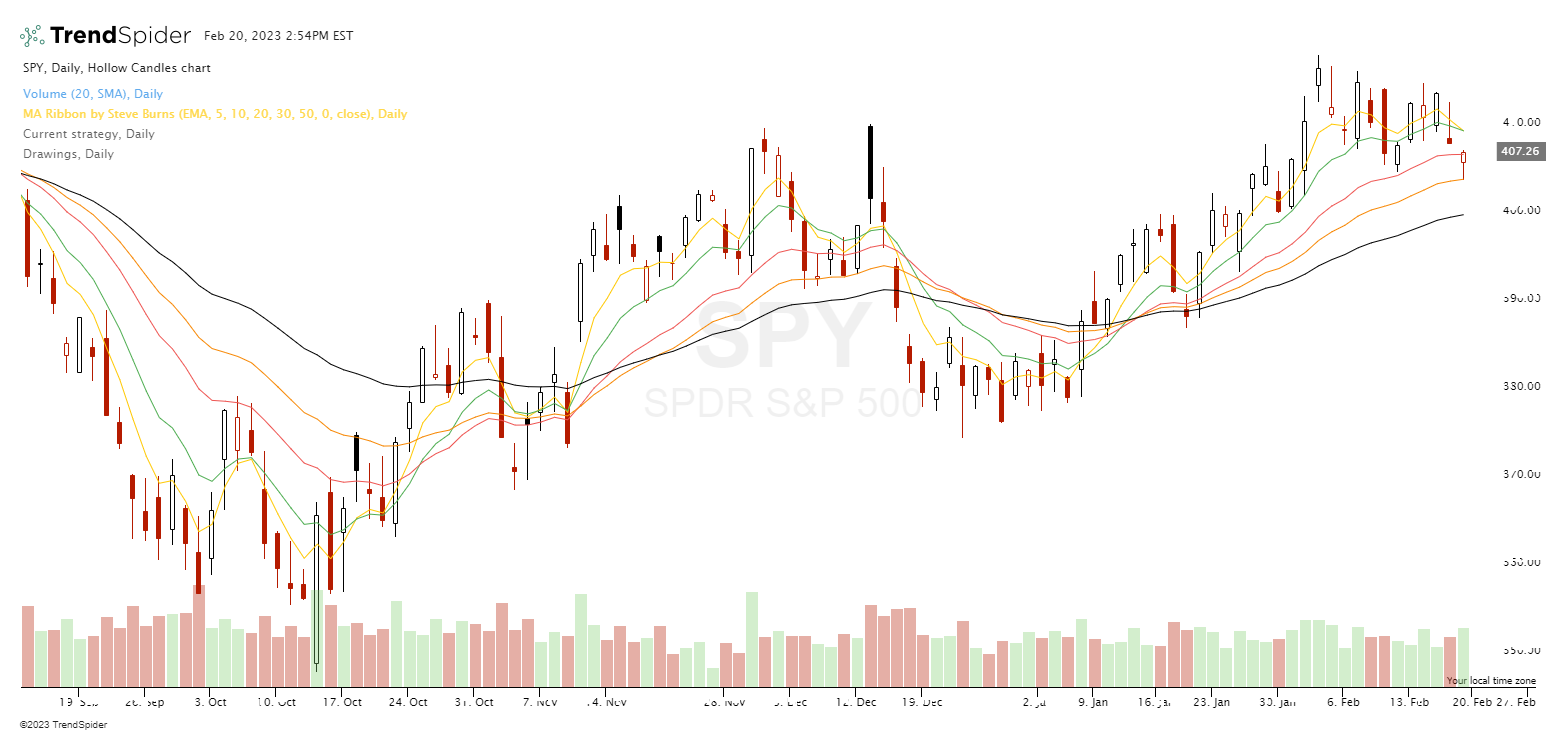

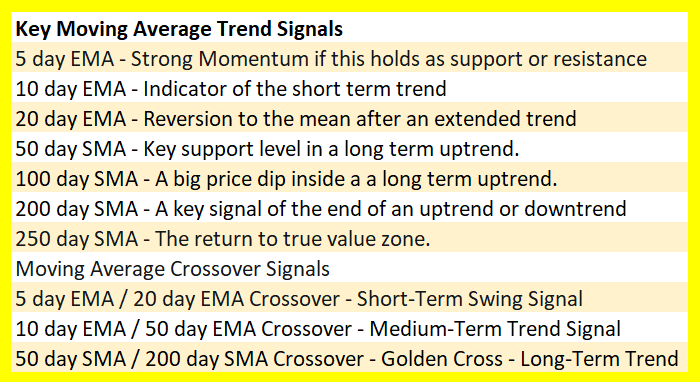

SPY 200-day Moving Average Strategy (Beats Buy and Hold)

Buy and hold investing is the strategy of buying a diversified portfolio of stocks using mutual funds or ETFs and holding them for the long-term. The normal hold time for buy and hold can be from 30 to 40 years. The strategy uses the historical returns for the U.S. stock market as its backtest. The […]

SPY 200-day Moving Average Strategy (Beats Buy and Hold) Read More »